Software goods or services under the Goods and Services Tax?

The information the technology industry is one of the biggest contributors to the Indian economy. ClinchSoft Company in Pune participates in software development and sales in India. With the implementation of the Goods and Services Tax, many entrepreneurs want to know whether software must be classified as goods or services and related goods and services tax rates on tax invoices. In this article, we clarify whether the software is a good or service under GST.

What is GST software?

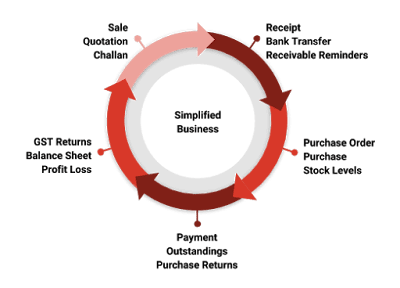

"One country, one law." With the latest historic initiatives of the Indian government, India has implemented Good and Service Tax (GST) laws. A simplified version of India's complex tax system. The Goods and Services Tax is a well-organized version of the central and state government's indirect taxes on goods and services. GST Software is an easy-to-use accounting and invoicing system designed to meet the specific needs of various business ClinchSoft organizations to track goods and services taxes. By using effective GST accounting software provide by ClinchSoft, ClinchSoft Software Development The company can easily and efficiently manage their accounts, inventory, finances, purchases, sales, taxes, payrolls, and various processes.

GST BILLING

SOFTWARE FOR ALL TYPES OF BUSINESS

The main features of GST accounting software provided by ClinchSoft:-

Given the importance of GST Software India, ClinchSoft organizations have adopted the implementation of GST solutions to achieve a smooth tax experience. In addition to the convenience of paying GST, commercial organizations also benefit from there. Here are some of them:

Professional Invoices- Print by email or offer a professional receipt with the client. Include your business logo and mark to be progressively proficient. Duplicate the receipt to make a comparable receipt.

GST Compliance- Invoices that meet GST, produce money related reports, perform tax calculations and find out about your GST Liability, and submit GST returns with no problem.

Barcode Support- Make a custom scanner tag for anything with the predefined number and rate. Utilize our implicit standardized tag group or make your very own scanner tag name. Produce a scanner tag promptly for all things in the buy request.

Quotations- Make professional statements and track site. Produce a receipt from the statement by tapping on it. Approach the provider to cite for your stock and create a buy request.

Multiple Rate Slabs- Characterize various rates for clients, retailers and discount providers. Characterize separate rates for units and boxes. Separate rates for each bunch.

SMS Notifications- Sending suggestions to clients can enable you to get paid quicker or send limited time messages to build deals. Send a robotized SMS receipt warning to your clients. Get a warning when stock is beneath a characterized dimension.

Reports and Analytics- Keep your business reliable with our detailed reports. Examination reports enable you to settle on educated choices.

Simplified CRM- Simplified yet adaptable CRM for overseeing deals inquiries and administration tickets. Expand CRM with your very own custom fields and status records.

Multi-User- The multi-client highlight enables various classes of clients to utilize various perspectives. Oversee consents for various client gatherings.

Outstanding- Get a helpful rundown of every single extraordinary record receivable and creditor liabilities whenever and have a reasonable comprehension of your business. Procedure pending solicitations by clicking Send warnings to all clients.

Import/Export- Import or fare all things or records from exceeding expectations in a basic manner. Import the receipt from exceeds expectations.

Documents- Deal with all reports by appending all records to the exchange.

Custom Fields- Utilize custom fields to extend tasks and records. Include custom fields in deals solicitations at the undertaking level and receipt level.

Go Green- Digitally send all invoices, ledger reports and reports by email and save paper. Send the report in pdf or excel format.

Importance of the GST Software for Our Business:-

GST billing

software or GST file software is very user-friendly provided by ClinchSoft

software development company, Pune and traders can easily use it to take

advantage of the tax system. Different activities that can be managed through

effective GST software include:

1. Billing.

2. Document

Printing.

3. Purchase

Transactions.

4. Taxations

reports.

5. Completely

user-friendly invoicing.

6. Extensive

financial accounting.

7. Inventory

Management.

Above all

features are available in all plans. Following plans are provided by

ClinchSoft:

PERSONAL (Single

User)

STANDARD (Single

User)

PREMIUM (Multiple

Users)

All the above plans

have free support for one year

PAY ONE TIME USE LIFETIME!

Contact Us for

More Details -

Office No-A2/1,

First Floor Goyal Building Near Nashik Phata,

Old Mumbai - Pune Hwy, Kasarwadi,

Pune, Maharashtra 34.

Phone

No.-8149842202

Visit Us Our

Website - www.clinchsoft.com

ReplyDeleteSuch an awesome blog thanks for sharing an useful information to all. Best Digital Marketing Company in Bangalore.Web Design Companies in Bangalore | Web Development Company in Bangalore |>Website Designing Company in Bangalore |Website Development Companies in Bangalore |Web Development Companies in Bangalore